4 FACTORS THAT CAN HELP

By Tara Mastroeni

Contributor – Real Estate

FORBES

__________________________________________________

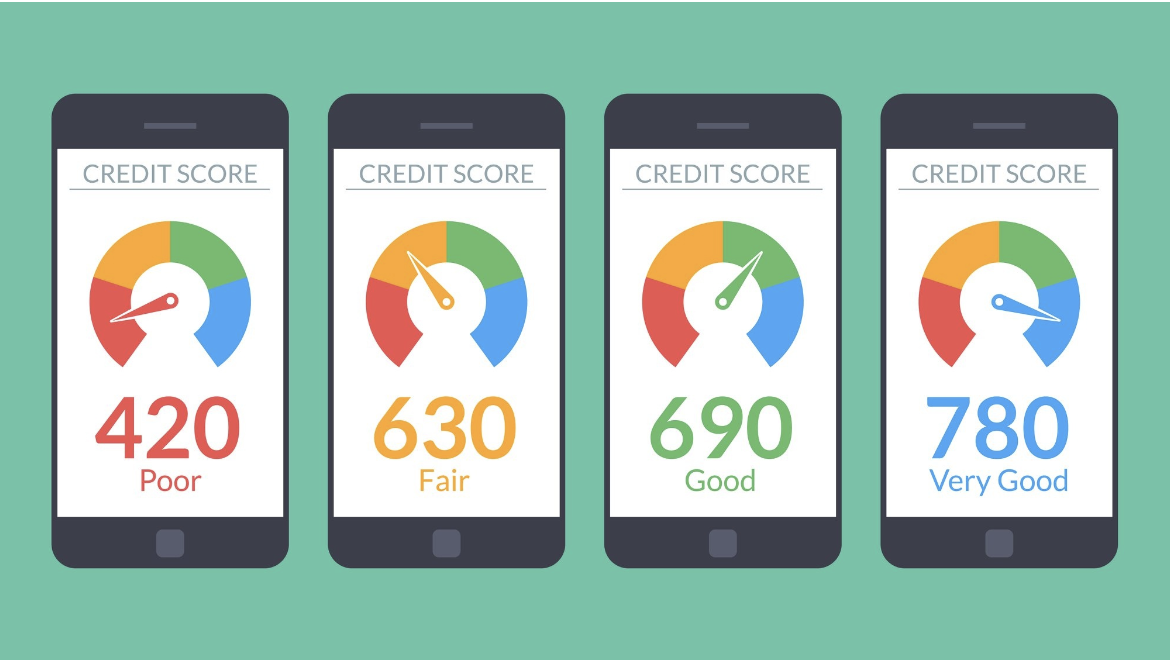

There’s no getting around the fact that one’s credit score is an important factor in being approved for a loan. However, it isn’t the be-all-and-end-all, and there are definitely other factors involved in determining one’s ability to afford to buy a home. I’ve laid them out below. If your credit score leaves something to be desired, consider looking at these four factors in order to achieve your dream of becoming a homeowner.

YOUR DEBT-TO-INCOME RATIO

In addition to your credit score, your debt-to-income ratio (DTI) is another factor that lenders take into account when deciding whether or not to approve you for a loan. Put simply, this ratio is the sum of all your monthly debt payments (including credit card debt, car payments, student loans, etc) divided by your total monthly income. These days, lenders typically look for a ratio of 50% or less.

Your first step should be to sit down and figure out your ratio is currently. To do so, add up all your debts. Then, divide the total by the sum of all your monthly income streams. If your ratio is currently higher than you’d like it to be, don’t worry. There are two options to improve it. You can do so by generating more income through a second job or a side hustle or by allocating more of your current income to pay down your debts.

However, before you start planning on how to tackle your DTI, your best bet is to talk to a lender. He or she will be able to look at the particulars of your financials in order to help you zero in on which money moves will have the greatest impact.

YOUR DOWNPAYMENT

Often, buying with bad credit comes down to looking for ways to reassure the lender that you’re a risk worth taking. Essentially, that means proving that you’re capable of paying back the money that you’ve borrowed. One way to do that is by bringing a larger-than-normal downpayment to the table.

Though, these days, most loans only require you to put down 3-5%, you should aim to have as large of a down payment as possible, at least 10%.

This method works to reassure lenders for two reasons. On the one hand, it shows that you have the ability to save up large sums of money, which is often seen as an indicator of financial responsibility. On the other, having a large downpayment lessens the amount of money that you need to borrow overall. This allows lenders to view you as less of a risk.

YOUR LOAN OPTIONS

Fortunately for those of us with less-than-perfect credit, there are loan options geared specifically toward catering to those with a lower score. Your lender may know of additional options that are unique to your area. However, these are the most common ones:

FHA Loans:

• Guaranteed by the Federal Housing Administration

• A score of 580 or higher qualifies for as little as 3.5% down

• A score of 500-580 qualifies, but you need to put at least 10% down

• PMI (mortgage insurance) over the life of the loan

VA Loans:

• Must have performed military service or be a military spouse

• Finance up to 100% of the property’s value

• No minimum credit score requirement (up to the individual lender)

• Does not require mortgage insurance

YOUR FAMILY & FRIENDS

Sometimes buying with bad credit comes down to asking for a little help from family or close friends. Here are two ways that they can assist you in your goal of becoming a homeowner.

CONSIDER USING GIFT MONEY Maybe your parents are financially capable of and generous enough to be able to help you with your downpayment or maybe your grandparents have been putting money aside for you since you were born. Either way, it is possible to use funds given to you to purchase a home. This is known as receiving gift money.

However, before you can accept any funds, you should talk to a lender. He or she can help you document the transfer of funds so they aren’t called into question during the underwriting process.

GET A CO-SIGNER If you’re truly unable to qualify for a loan on your own, you may be able to do so with the help of a co-signer. A co-signer is someone (usually it must be a primary family member) who has good financial standing and is able to provide some peace of mind for the lender. The co-signer essentially agrees to step in and take care of the loan if you stop paying or are unable to keep making payments.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link